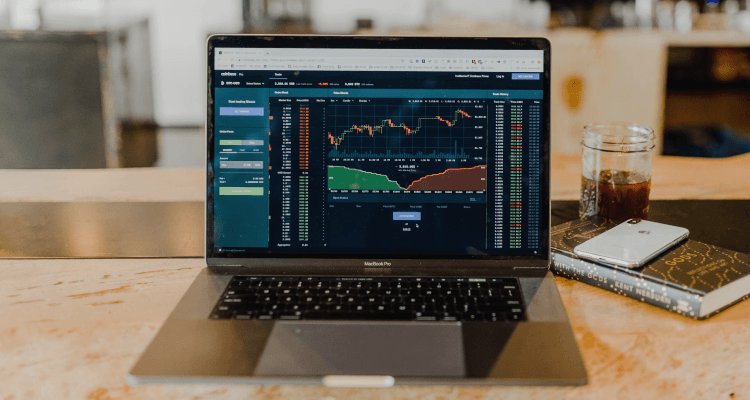

Nasdaq is going to launch a crypto custody service for BTC and ETH in 2023

Bloomberg news has recently reported that New York-based Nasdaq Stock Exchange is looking to launch a crypto custody service by the end of the second quarter. The exchange intends to start its digital assets business with custody services for the two largest cryptocurrencies by market cap — Bitcoin and Ethereum. The head of Nasdaq Digital Assets, Ira Auerbach, said that the exchange has been working on establishing solid infrastructure and securing the necessary regulatory approvals that will allow it to serve crypto customers. Auerbach added that custody is the first step in its plans to set up a broad range of services for digital assets.

Telegram allows Users to Transfer USDT Through Chats

Telegram has introduced a new feature that allows its users to transfer USDT, the leading stablecoin by market capitalization, directly within the messaging platform. It became possible by integrating USDT into the @wallet Telegram wallet bot, which enhances the app's capability to facilitate cryptocurrency transactions.

The inclusion of crypto payments within messaging applications like Telegram is expected to increase their usage, making sending digital currencies as simple as sending a text message or a photo.

Tether feasts during the plague

Tether, a leading cryptocurrency firm, is thriving despite the ongoing downturn. The company is anticipating a profit of $700 million for the March quarter and a $1.7 billion increase in its overall holdings. Tether is the issuer of the USDT stablecoin, which is linked to the US dollar and backed by tangible assets like fiat currency and US Treasuries.

One reason for Tether's growth is the recent crisis at Silicon Valley Bank, which has harmed their competitor, the stablecoin USD Coin (USDC). In response, investors have turned to Tether, demonstrating its stability and reliability.

As a result of its steady performance and the increase in its reserves, Tether is becoming increasingly attractive to investors and traders in the cryptocurrency market.